Automotive News and Reviews for the Petrolhead

In this week's issue:

- Car Briefs

- Slow Sales Dent Carmakers' Racing Ambitions

- BMW Misses 3rd Quarter Forecast

The new C2 Design special edition is available with a choice of two petrol engines - a 61bhp 1.1 unit and a 75bhp 1.4 unit. The new Design special editions slot in above the entry level L models, adding a CD player, electric front windows and body coloured bumpers and rubbing strips. This is in addition to the standard specification of variable power assisted steering, ABS with Electronic Brakeforce Distribution and Emergency Braking Assistance as well as remote control central locking with deadlocks.

The Design 1.1 costs £8,295 and the 1.4 costs £8,795. However, until the end of November, the Design 1.1 comes with one year's free insurance for buyers aged 19 and over who purchase their car via CitroŽn's Elect 3 finance scheme, while the Design 1.4 is available with £800 cashback.

The technological marvel (all-aluminium body, drag co-efficient of 0.28) has always seemed like an expensive solution looking for a solution. Now, Audi is offering the 1.4 (75PS) Special Edition and A2 1.4 TDI (75PS) Special Edition models at prices of £12,715 and £13,695 respectively.

As from January 2005, the new versions replace all current A2 Standard, SE and Sport models. Special Edition models add electronic climate control and a Concert radio with single CD player to the A2 standard equipment list, which includes 15-inch alloy wheels and remote control central locking.

The new model will be manufactured in Italy by Pininfarina, the company which already produces the Ford Streetka. Ford has said the decision to put the car into production was in response to "outstanding" media and public reaction at Paris. However, Ford really had little choice: with most of its European rivals producing, or planning, such models, it could not be left behind. Ford is desperate to improve its image in Europe and a fashionable version of the Focus is an important part of that strategy.

Power is up from 224 bhp to 272 bhp, while fuel consumption improves to 29.1 mpg (saloon) or 28.5 mpg (estate). Prices, which include a seven speed automatic, start at £35,770 and the new models will be available from November 2004.

Faced with sluggish car markets and pressure on profits, automakers are being forced to weigh up the benefits of their high-profile but expensive involvement in international rallying and Formula One.

France's PSA Peugeot Citroen said last week it would pull out of the World Rally Championships after 2005, the latest in a string of manufacturers to scale back their involvement in the sport.

U.S. rival Ford sent shockwaves through Formula One when it said in September it was pulling its Jaguar team out of the sport, while a core group of car companies are threatening to launch a breakaway movement, saying the current system doesn't give them enough of the earnings.

Motor sports provide car makers with a showcase for their brands in key markets and an opportunity to show off their technological expertise, although the high-powered vehicles often have little in common with the models sold to the public.

"It's a form of advertising that pays off if the team is successful, and the impact is increased if you can get a driver from a key market, as Renault have done with French, Italian and Spanish drivers," Commerzbank analyst Adam Collins said.

But investments in motor sport can run to hundreds of millions of euros, significant sums at a time when lacklustre demand for cars in the key western European market has taken a chunk out of the industry's earnings.

"It is of questionable value in a downturn," said Commerzbank's Collins. "As we see things getting tougher next year, with high raw material costs and potential demand shortfalls it is an area that no doubt will be looked at again."

Rally Pull-Out

As well as pulling out of the WRC, PSA said it would be re-examining its overall participation in motor sport in the light of difficult market conditions.

"Due to tougher conditions in the car market, new opportunities in motor sports will be reviewed in 2005, with a view to enabling the Group to significantly cut its sports budget," a company statement said.

PSA already pulled out of Formula One in 2000 after a difficult season supplying engines to the Prost team.

Analysts said the benefits of continued participation were particularly questionable for brands that have enjoyed a spell at the top of a sport, as Peugeot and Citroen have in rallying. Peugeot and Citroen have, between them, won the last five WRC manufacturers' titles as well as three drivers' championships.

"When you're at the top you can only really go downhill and risk damaging your image," said Chris Will of Lehman Brothers.

"Current conditions in the car market and pressures on earnings mean all firms are going to be reviewing their involvement, but the first to pull out will be those who have either achieved their goals or who are going nowhere," he added.

PSA is not the first to cut back on rally spending. Mitsubishi skipped several rounds this season, and Skoda, owned by Germany's Volkswagen, scaled back its involvement in 2004. So far only Ford is committed to staying in the championship beyond 2005.

Last month General Motors said it would end its participation in Germany's Touring Car Masters rally when it announced job cuts and a review of spending. WRC Team bosses and the governing International Automobile Association met on Friday to discuss measures to cap the cost of participating, including the use of common parts and a limit on expensive development.

Frustration

In Formula One racing, which requires a greater investment but is much more lucrative than rallying, constructors are also reassessing the value of their involvement.

Ferrari's dominance over recent seasons has been a source of frustration for its rivals, whose mainstream car brands have been denied a top podium place time and again by a luxury name that does not have to battle in the mass market.

What is more, BMW, Renault, DaimlerChrysler's Mercedes and even Ferrari are unhappy with the current division of Formula One's commercial rights, of which they get about a quarter, and are threatening to form a breakaway championship.

"What they are proposing makes sense, given the revenue stream they get from the sport today," Commerzbank's Collins said.

In the meantime, changes in the sport's rules and structure could mean it no longer provides car makers with the showcase it once did. Alterations to the championship that could take in races in locations in the Middle East and Asia and drop some European races would reduce constructors' exposure to some of their biggest markets.

"If talk about dropping the French race becomes a reality, then investment in the sport would be more questionable," Collins said.

And proposed changes in regulations, aimed to encourage smaller constructors to take part by removing financial barriers, could also put off constructors who want a showcase for their technology.

"A one-size-fits-all process, with a dumbing down in technology, would make the sport less of a showcase for the biggest constructors," Collins said.

BMW has reported a lower-than-expected 7.6 percent rise in third-quarter pretax profit, but has reaffirmed its forecast for record revenues, earnings and car sales in 2004. Quarterly earnings before taxes rose to 779 million euros (538 million pounds) from 724 million in the year-ago period, the German premium carmaker said last week, short of an average estimate of 819 million euros in a Reuters survey of 25 analysts.

"Bolstered by the strong third-quarter performance, the BMW Group anticipates that the development achieved during the first nine months of 2004 will be sustained in the fourth quarter," Chief Executive Helmut Panke said in a statement.

Shares fell sharply in early trading nonetheless, down 2.0 percent at 33.13 euros by 8:38 a.m., compared to a 0.4 percent gain in the DJ Stoxx European Autos Index.

"The figures look relatively disappointing at first glance," Metzler Bank analyst Juergen Pieper said.

The primary reason results fell short of expectations was a 92 million-euro swing to a loss of 43 million in BMW's reconciliation to group earnings line, which covers areas outside automotive, motocycles and financial services.

"The deviation comes from the leasing business," said HVB analyst Georg Stuerzer, adding that the growth in BMW's leasing business would shift profits into the future, however.

"The deciding factor for me was the development in its core automotive division and here the gap was really small," Stuerzer added.

Profits at the automotive division leapt 21.8 percent to 694 million euros before tax on a 13.8 percent rise in revenues to 10.3 billion. Third-quarter group revenues rose 6.3 percent to 10.6 billion euros and net profit gained 7.6 percent to 479 million.

Surpasses Mercedes

Capitalising on a string of problems at Mercedes Car Group, BMW is pulling quickly away from its arch rival to become the largest and most profitable premium carmaker in the world.

Buoyed by the launch of several new models this year such as the 1-Series hatchback, BMW sold 887,293 cars over the first nine months of 2004, up 8.8 percent from a year earlier and surpassing DaimlerChrysler's luxury unit.

Mercedes reported a 62 percent decline in third-quarter operating profit last week and warned that full-year results would be "substantially" lower as management struggles to get a grip on quality problems and a significant deterioration in the performance of its Smart brand of compact cars.

Analysts expect growth at BMW to continue into 2005, thanks in large part to the relaunch of its best-selling model, the 3-Series, starting on March 5. Despite BMW's remarkable run of success, the stock has failed to outperform its peers due to underwhelming 2004 guidance and concerns that negative currency effects could wipe out hundreds of millions of euros in profits next year.

The share has fallen more than 8 percent in the year to date, while the European Autos Index has dipped 0.3 percent.

![]() Car Briefs

Car Briefs

Citroen has introduced a new special edition - the C2 Design.

Citroen has introduced a new special edition - the C2 Design.

Audi has finally acted to deal with the one problem of the A2 - its eye-watering pricetag.

Audi has finally acted to deal with the one problem of the A2 - its eye-watering pricetag.

Ford has confirmed that the Focus Coupe-Cabrio concept car, shown at the recent Paris Motor Show will go into production in late 2006.

Ford has confirmed that the Focus Coupe-Cabrio concept car, shown at the recent Paris Motor Show will go into production in late 2006.

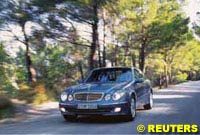

Mercedes is replacing the in-line six cylinder E320 with a new V6 E350. The new 3.5 litre engine has already been seen in the new SLK and offers significant performance advantages over the outgoing model.

Mercedes is replacing the in-line six cylinder E320 with a new V6 E350. The new 3.5 litre engine has already been seen in the new SLK and offers significant performance advantages over the outgoing model.

![]() Slow Sales Dent Racing Ambitions

Slow Sales Dent Racing Ambitions

![]() BMW Misses 3rd Quarter Forecast

BMW Misses 3rd Quarter Forecast

| Contact the Editor |

© 2007 autosport.com . This service is provided under the Atlas F1 terms and conditions.

|

Volume 10, Issue 45

Atlas F1 Exclusive

Interview with Peter Sauber

2004 Season Review

A Long Dry Summer

One Shot: 2004 Through the Lens

The 2004 Season in Quotes

2004 Trivia Quiz

Columns

On the Road

Elsewhere in Racing

The Weekly Grapevine

> Homepage |